Southeast Asia Aluminium Recycling Market, Outlook and Forecast 2024-2030

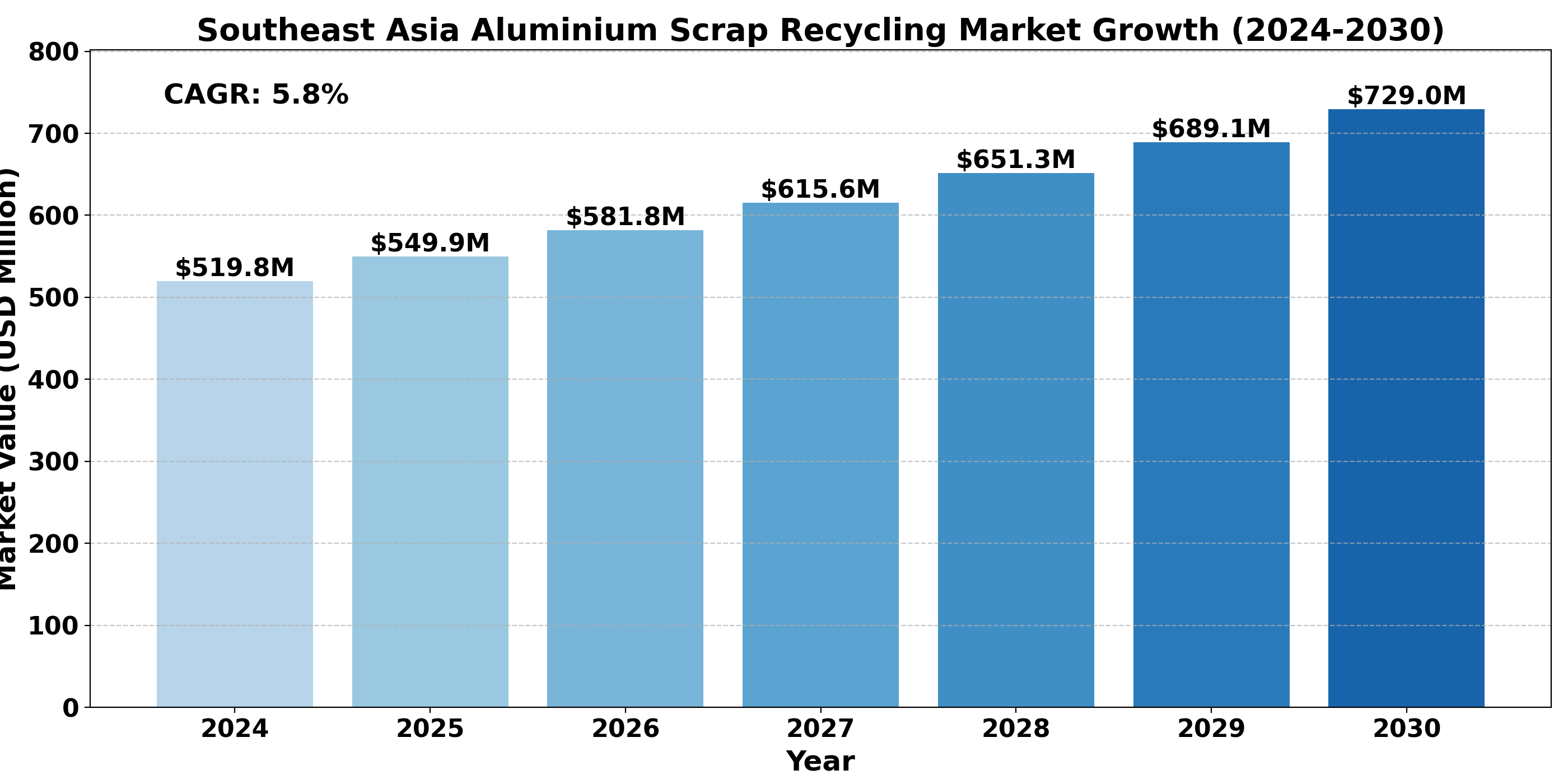

The "Southeast Asia Aluminium Scrap Recycling Market" was valued at US$ 519.8 million in 2024 and is projected to reach US$ 783.7 million by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period (2024-2030).

The Southeast Asia aluminium scrap recycling industry has been growing steadily, driven by the region's expanding manufacturing and construction sectors. Because of their growing industrial activity and need for sustainable resources, nations like Vietnam, Malaysia, Thailand, and Indonesia have emerged as major players. Since recycling uses a lot less energy than producing aluminium directly, it is the most environmentally beneficial and energy-efficient kind of aluminium recycling in this area. The recycling sector has also benefited from government initiatives that support trash reduction and circular economies. However, obstacles like uneven scrap quality, inadequate infrastructure in some places, and volatile aluminium prices can hinder the sector's expansion. Despite these obstacles, Southeast Asia continues to be a desirable location for recycling aluminium scrap, and the industry's future growth is being supported by rising investments and technological developments.

Southeast Asia's advantageous location in the global aluminium supply chain also helps the region's recycling sector. The area serves both domestic and foreign markets, such as China and India, by exporting a significant amount of recycled aluminium ingots and semi-finished goods. Nevertheless, the sector has to contend with issues like uneven scrap quality, inadequate infrastructure for collecting in some places, and competition from imported scrap. Furthermore, the profitability of recycling operations may be impacted by changes in the price of aluminium on the international market.

The Aluminium Ingot Scrap holds the highest market share: By Type

In terms of type, the Southeast Asia Aluminium Scrap Recycling Market has been segmented as Aluminium Foil Scrap, Aluminium Ingot Scrap, and Others.

Aluminium ingot scrap has the largest market share in Southeast Asia's aluminium scrap recycling market, ahead of aluminium foil waste and other varieties. The widespread usage of aluminium ingots in a number of high-demand industries, including manufacturing, construction, and the automotive sector, is what is responsible for this supremacy. Because recycled aluminium ingots can be effectively melted down and repurposed in industrial processes without losing their quality or features, they are an essential input material for creating new products. Aluminium ingots' wide range of applications stems from their ability to be used to create castings, sheets, and extrusions, which helps explain their significant market share in recycled aluminium.

Furthermore, rising awareness of cost-effectiveness and environmental sustainability has led to a significant increase in demand for secondary aluminium ingots. Recycling aluminium ingots is a desirable alternative for businesses trying to lower energy use and carbon emissions because it can save up to 95% of the energy needed to generate primary aluminium. On the other hand, because of its lower material value and greater danger of contamination, aluminium foil scrap, despite being widely utilised in packaging and household products, makes up a smaller portion of the recycling market. Due to a lack of industrial demand, the "other" category which comprises various types of aluminium scrap such cans and machinery parts—also lags behind aluminium ingot scrap in terms of market share.

Construction to hold the highest market share: By Application

In terms of Application, the Southeast Asia Aluminium Scrap Recycling Market has been segmented as Packaging, Electronics, Machinery & Equipment, Construction and Others.

When compared to other applications such as packaging, electronics, machinery & equipment, and others, the construction industry has the largest market share in Southeast Asia's aluminium scrap recycling market. This is mostly because to the area's fast industrialisation, infrastructure expansion, and urbanisation, all of which necessitate significant amounts of aluminium in different forms. Because of its strength, light weight, and ability to withstand corrosion, aluminium is frequently used in construction for items like windows, doors, roofing, cladding, and structural elements. Because recycled aluminium offers substantial economic and environmental benefits by lowering the need for primary aluminium production, which is energy-intensive, the desire for sustainable building materials has further increased the usage of recycled aluminium.

The governments of Southeast Asia are investing more and more on large-scale infrastructure projects, such as transportation infrastructure including roads, bridges, and airports, as well as residential, commercial, and industrial structures. The construction industry is the biggest consumer of recycled aluminium waste due to the increase in demand for aluminium goods. Additionally, developers and contractors are being encouraged to use recycled aluminium, which is economical and environmentally friendly, as a result of the global movement towards greener building practices and energy-efficient materials.

Regional Overview

The rapid rise of the aluminium scrap recycling business in Southeast Asia is a result of the region's industrialisation, economic progress, and growing environmental consciousness. Leading nations that are using their industrial sectors to boost demand for recycled aluminium include Indonesia, Thailand, Malaysia, Vietnam, and the Philippines. Key growth drivers are urbanisation and infrastructural development, especially in the aluminium-heavy electronics, automotive, and construction sectors. Recycling efforts are being further stimulated by the fact that governments around the area are prioritising sustainability through policies that support circular economies, waste reduction, and resource efficiency.

Competitive Analysis

A combination of well-established regional firms, global players, and emerging players to take advantage of the region's rising demand for recycled aluminium make up the competitive environment of the Southeast Asian aluminium scrap recycling market. Due to their extensive knowledge of local markets, access to scrap supply chains, and strong connections with domestic industries—particularly in manufacturing and construction—local businesses can enjoy a competitive edge. The market is dominated by major regional players like Nanshan Group and Ye Chiu Metal Smelting, etc. who take advantage of government programs that encourage recycling and circular economies as well as their established connections with significant industrial clients.

Recent Development

⣠April, 23rd, 2024, Ye Chiu Metal Smelting has received the ASI Performance Standards V3(2022) Certification for its secondary aluminium alloy ingot manufacturing operation in Johor Malaysia.

⣠March 11, 2024, China Hongqiao's subsidiaries announced the successful obtaining of ASI performance standard certificate. This significant event shows the company's steadfast commitment to sustainability and responsible aluminium production.

Industry Dynamics

Industry Drivers

Increasing Emphasis on Sustainability and Circular Economic Practices.

The increasing focus on sustainability and circular economy principles is one of the main factors propelling Southeast Asia's aluminium scrap recycling sector. To fulfil international environmental goals and lessen dependency on raw resources, governments in the region—including those in Vietnam, Thailand, and Indonesia—are progressively enacting laws and policies that encourage recycling and trash reduction. There is a growing need for sustainable materials like recycled aluminium, which may save up to 95% of the energy used to produce primary aluminium while reducing greenhouse gas emissions, as businesses and consumers grow more environmentally conscious.

Businesses in industries including construction, automotive, and packaging are being pushed to use more recycled materials by this trend towards green manufacturing and construction methods as well as corporate sustainability programs. In addition to fostering the expansion of the aluminium scrap recycling sector, this market-driven and regulatory emphasis on sustainability is establishing it as a vital component of the area's future industrial progress.

Industry Trend

Increasing Adoption of Advanced Technology in order to improve efficiency and recovery rate.

The growing use of cutting-edge technologies to boost productivity and recovery rates is a significant trend in the aluminium scrap recycling sector in Southeast Asia. Businesses are investing in technology like artificial intelligence (AI), machine learning, and automated sorting systems to improve the accuracy of scrap identification and separation as the demand for premium recycled aluminium rises. By decreasing contamination and increasing the recovery of useable aluminium from mixed scrap sources, these technologies assist recyclers in streamlining the process.

Furthermore, more energy-efficient melting procedures are becoming possible thanks to developments in furnace technologies, which further lower expenses and their negative effects on the environment. In line with the region's emphasis on sustainability and resource efficiency, this technology revolution is revolutionising the recycling sector by making operations more effective, scalable, and ecologically friendly. Companies that embrace these technological innovations are gaining a competitive edge in the rapidly evolving market.

Industry Restraint

Lack of Efficient and consistent Scrap Collection Infrastructure

The absence of reliable and effective scrap collection infrastructure throughout the region is a significant barrier to the aluminium scrap recycling sector in Southeast Asia. Although there is an increasing need for recycled aluminium, particularly in sectors like construction and automotive, the supply of high-quality scrap is frequently constrained by insufficient collection infrastructure. The informal sector continues to play a significant part in the fragmented scrap recycling business in many Southeast Asian nations, resulting in uneven supply chains and varying quality. Limited public awareness and official procedures for scrap collection and segregation, particularly in rural regions, further aggravate this. Furthermore, contamination problems that occur when aluminium scrap is combined with other materials make it more difficult to process effectively impede the recycling process.

Because of this, recyclers frequently struggle to find enough clean, high-quality scrap to satisfy industrial demand, which affects their profitability and operating efficiency. Therefore, the need for greater infrastructure, more enforcement of regulations, and broader acceptance of formal recycling procedures limit the industry's potential for expansion. The industry's capacity to grow and satisfy the region's rising demand for aluminium may be seriously impeded if these issues are not resolved.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis Product Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors

Attributes

Details

Segments

By Size:

By Product Type:

Region Covered

Key Market Players

Report Coverage

Table of Content:

1 Market Overview

1.1 Product Overview and Scope of Aluminium Recycling

1.2 Segment by Type

1.2.1 Southeast Asia Market Size YoY Growth Rate Analysis by Type: 2023 VS 2030

1.2.2 Aluminum Ingot

1.2.3 Aluminium Flat Rolled Products

1.2.4 Others

1.3 Segment by Application

1.3.1 Southeast Asia Market Size YoY Growth Rate Analysis by Application: 2023 VS 2030

1.3.2 Transportation Industry

1.3.3 Packaging

1.3.4 Construction

1.3.5 Electronics

1.3.6 Others

1.4 Southeast Asia Market Growth Prospects

1.4.1 Southeast Asia Revenue Estimates and Forecasts (2019-2030)

1.4.2 Southeast Asia Production Estimates and Forecasts (2019-2030)

2 Southeast Asia Growth Trends

2.1 Industry Trends

2.1.1 SWOT Analysis

2.1.2 PESTEL Analysis

2.1.3 Porter’s Five Forces Analysis

2.2 Potential Mar

CONTACT US:

203A, City Vista, Fountain Road, Kharadi, Pune, India - 411014

International: +1(332) 2424 294

Asia: +91 9169162030

Follow Us On LinkedIn: 24ChemicalResearch LinkedIn