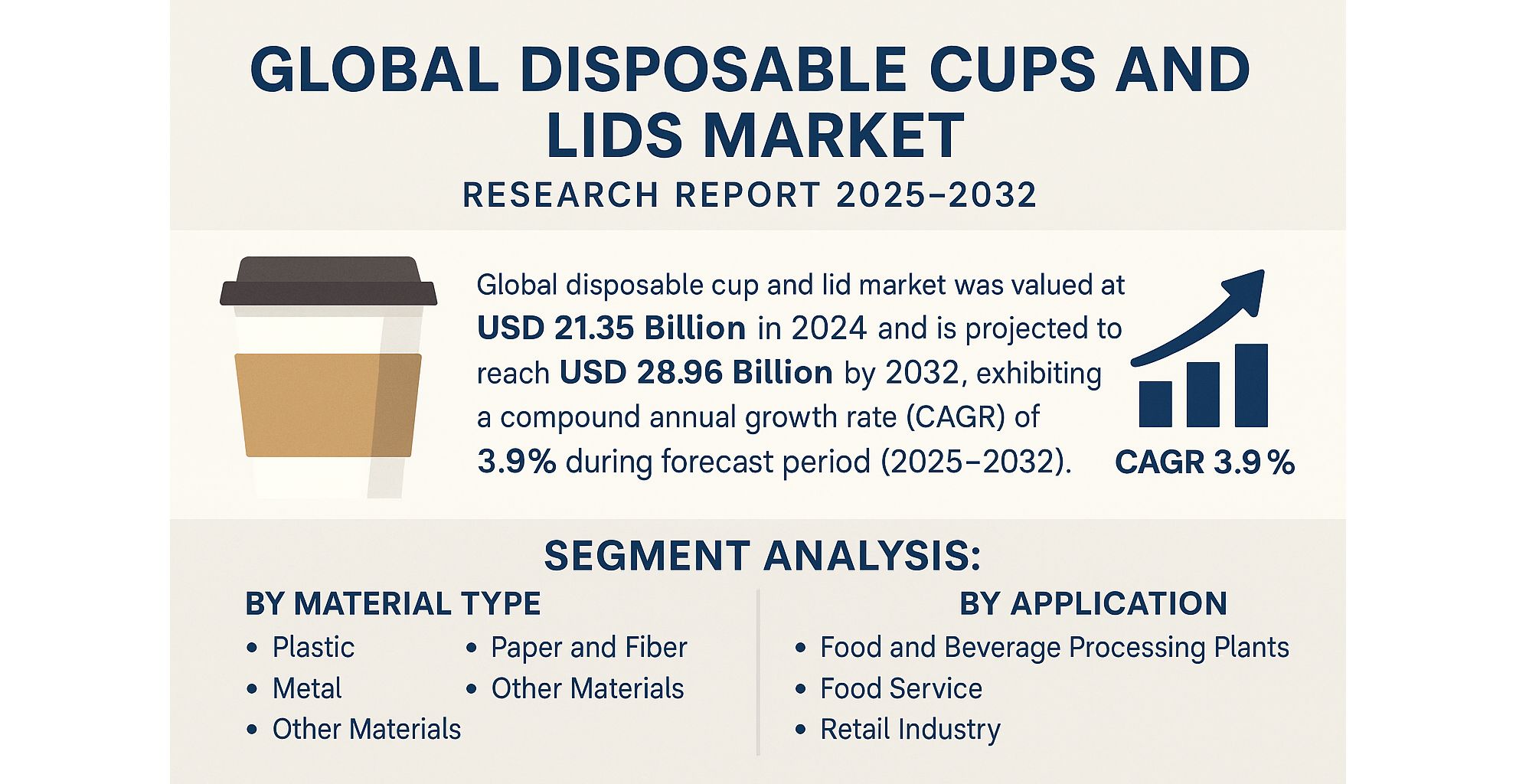

Global Disposable Cups and Lids Market Research Report 2025-2032

Global disposable cup and lid market was valued at USD 21.35 billion in 2024 and is projected to reach USD 28.96 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.9% during the forecast period .

Disposable cups and lids are single-use packaging solutions designed for convenience in food and beverage consumption. These products are widely used across food service, retail, and industrial applications due to their cost-effectiveness, hygiene, and ease of disposal. The market is segmented by material type, including plastic, paper and fiber, metal, and other alternatives, catering to diverse consumer preferences and environmental regulations.

Growth in the market is driven by increasing demand for on-the-go food and beverage consumption, particularly in urban areas. The food service industry remains the largest consumer, followed by retail and industrial applications. However, environmental concerns and regulatory restrictions on single-use plastics are pushing manufacturers to innovate with biodegradable and compostable materials. Key players in the market include Georgia-Pacific, Huhtamaki, Dart Container, and International Paper, among others, who are actively expanding their product portfolios to meet evolving consumer and regulatory demands.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Convenience in Food Services to Fuel Market Growth

Global disposable cups and lids market is experiencing robust growth, primarily driven by the increasing demand for convenience in food services. The foodservice industry, which includes quick-service restaurants (QSRs), cafés, and takeout establishments, relies heavily on disposable packaging solutions for operational efficiency and customer satisfaction. Statistics indicate that the global foodservice market is projected to exceed $4.2 trillion by 2026, creating substantial demand for disposable cups and lids. Furthermore, changing consumer lifestyles, characterized by busier schedules and preference for on-the-go consumption, are accelerating this trend. The COVID-19 pandemic further amplified the need for single-use packaging as hygiene concerns took precedence, with food delivery platforms experiencing a 45% increase in orders during peak pandemic periods.

Sustainability Initiatives and Bio-based Materials to Propel Market Expansion

Growing environmental consciousness and regulatory pressure are pushing manufacturers to innovate with eco-friendly materials, creating new growth avenues. While plastic remains dominant, biodegradable and compostable alternatives made from materials like polylactic acid (PLA), bagasse, and bamboo are gaining traction. The global market for biodegradable plastics in packaging is expected to surpass $14 billion by 2027, reflecting this shift. Major brands are responding to consumer preferences; for instance, over 60% of QSRs in North America and Europe have committed to phasing out conventional plastics in favor of sustainable alternatives by 2030. Government policies such as single-use plastic bans in over 120 countries are further accelerating this transition, making sustainable disposable cups and lids a critical focus area for industry players.

Expansion of Coffee Culture and Specialty Beverages to Drive Product Demand

The global proliferation of coffee culture and specialty beverages is significantly contributing to market growth. The coffee shop segment alone is projected to grow at 5.5% CAGR through 2030, with over 200,000 outlets operational worldwide. Cold brew, bubble tea, and artisanal beverage trends require specialized cup designs with secure lids, creating demand for advanced product solutions. The Asia-Pacific region, particularly China and Southeast Asia, has emerged as a hotspot with bubble tea chains expanding rapidly – the segment now accounts for 22% of all disposable cup usage in these markets. Major chains are increasingly adopting double-walled cups for insulation and leak-proof lids for enhanced customer experience, further driving innovation and premiumization in the sector.

MARKET RESTRAINTS

Fluctuating Raw Material Prices to Challenge Market Stability

The disposable cups and lids market faces significant headwinds from volatile raw material costs. Petroleum-based plastics, which account for approximately 65% of production, are sensitive to crude oil price fluctuations that have varied by over 40% annually in recent years. Meanwhile, paper prices increased by 23% in 2022 alone due to supply chain disruptions. These cost pressures squeeze manufacturer margins, particularly for small and medium enterprises that lack purchasing power. Alternative materials like PLA currently cost 25-30% more than conventional plastics, making adoption challenging for price-sensitive markets. This economic pressure creates a complex balancing act between sustainability commitments and maintaining affordable pricing structures.

Regulatory Complexity and Compliance Costs to Limit Market Growth

Stringent and evolving regulatory landscapes present substantial barriers to market expansion. The EU's Single-Use Plastics Directive (SUPD) and similar regulations in North America require costly reformulations and certification processes – compliance costs can reach $500,000 per product line for multinational corporations. Meanwhile, conflicting regional standards create operational complexities; for example, compostability certifications differ between the EU's EN 13432 and the US's ASTM D6400 standards. These regulatory hurdles are particularly challenging for smaller manufacturers with limited R&D budgets. Furthermore, extended producer responsibility (EPR) schemes now being implemented in 45 countries add 10-15% to product costs through mandatory waste management contributions.

Consumer Perception and Behavior Gaps to Slow Sustainable Adoption

Despite growing environmental awareness, disconnect between consumer attitudes and purchasing behavior continues to hinder market transformation. While 68% of consumers claim to prefer sustainable packaging, only 23% are willing to pay premium prices according to market studies. This discrepancy slows investments in sustainable solutions by manufacturers. Moreover, confusion persists around proper disposal – less than 30% of consumers correctly differentiate between compostable and recyclable materials, leading to contamination in waste streams. Such behavioral challenges undermine the environmental benefits of advanced materials and complicate lifecycle assessments, creating uncertainty about which solutions truly offer the best sustainability profile.

MARKET OPPORTUNITIES

Smart Packaging and IoT Integration to Open New Revenue Streams

The emergence of smart packaging technologies presents transformative opportunities for the disposable cups and lids market. Embedded QR codes, NFC tags, and temperature-sensitive inks are enabling interactive consumer engagement and supply chain optimization. The smart packaging sector is projected to grow at 8.2% CAGR through 2028, with foodservice applications representing the fastest-growing segment. Recent innovations include cups that change color to indicate beverage temperature and lids with integrated payment functionality. Major coffee chains have pilot tested cups with augmented reality features, seeing 35% higher customer engagement rates. This convergence of packaging and digital technology creates opportunities for premium product offerings and value-added services.

Emerging Markets and Urbanization to Drive Next Growth Phase

Urbanization trends in developing economies represent a significant growth frontier. The Asia-Pacific disposable cup market is expanding at 6.8% annually, nearly double the global average, fueled by 50 million new urban consumers entering the middle class each year. India's QSR market alone is growing at 25% year-over-year, requiring 8 billion additional disposable cups annually. Similar patterns are evident in Latin America and Africa, where urbanization rates exceed 2.5% annually. These regions also show greater price sensitivity, creating demand for affordable yet functional solutions that balance cost and performance – an area where regional manufacturers are increasingly innovating with localized material solutions.

Circular Economy Models to Revolutionize Product Lifecycles

Advancements in recycling infrastructure and closed-loop systems are creating new business model opportunities. Chemical recycling technologies can now process multi-layer cups previously considered unrecyclable, with several pilot plants achieving 90% material recovery rates. Deposit return schemes for disposable cups are being tested in European cities, showing 78% return rates. Meanwhile, cup-to-cup recycling programs by major brands demonstrate the potential for true circularity. The global recycled plastics market is expected to reach $72 billion by 2028, with food-grade rPET commanding premium pricing. These developments enable manufacturers to participate in circular value chains, potentially converting waste liability into revenue streams while meeting sustainability targets.

MARKET CHALLENGES

Recycling Infrastructure Gaps to Complicate Sustainability Efforts

Despite growing adoption of recyclable and compostable materials, inadequate waste management systems remain a critical challenge. Only 9% of plastics produced since 1950 have been recycled, and current recycling rates for disposable cups hover around 20% in developed markets. The situation is worse for compostable alternatives, as fewer than 50% of U.S. households have access to industrial composting facilities. Multi-layer packaging, used for insulation and liquid resistance, poses particular difficulties - less than 5% is currently recycled globally. These systemic gaps undermine the environmental benefits of advanced materials, creating skepticism among environmentally conscious consumers and regulators about the efficacy of current solutions.

Material Performance Trade-offs to Limit Product Innovation

Developing sustainable materials that meet functional requirements remains an engineering challenge. Bio-based plastics often lack the heat resistance of conventional plastics, with PLA cups deforming above 60°C compared to PET's 70°C threshold. Paper-based solutions require plastic coatings for liquid resistance, complicating recyclability. These performance gaps lead to higher product failure rates - hot beverage leakage complaints are 30% more common with compostable cups versus conventional options. Finding solutions that balance sustainability, functionality, and cost-effectiveness requires significant R&D investment, with material science breakthroughs often taking 3-5 years from lab to commercialization.

Brand Liability and Greenwashing Concerns to Heighten Scrutiny

Increasing legal and reputational risks around environmental claims present growing challenges for market participants. Over 40% of sustainability claims on packaging fail regulatory scrutiny, according to recent audits. Legal actions against companies for misleading biodegradable or compostable claims have increased by 300% since 2020. This regulatory scrutiny is compounded by sophisticated consumer advocacy groups using forensic testing to validate environmental claims. Such risks force manufacturers to navigate complex compliance landscapes while maintaining transparent communication – a delicate balance where missteps can result in significant brand damage and erosion of consumer trust in sustainable product alternatives.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies Strive to Strengthen Their Market Position Through Innovation and Expansion

The global disposable cup and lid market is highly competitive, with both established players and emerging companies vying for market share. Huhtamaki currently leads the market, leveraging its extensive product portfolio and strong distribution network across North America, Europe, and Asia-Pacific.

Dart Container Corporation and Georgia-Pacific also hold significant market positions, with their growth driven by continuous product innovation and strategic acquisitions. These companies have been expanding their production capacities to meet the rising demand for sustainable packaging solutions.

Meanwhile, International Paper and Greiner Packaging are focusing on developing eco-friendly alternatives to plastic cups, capitalizing on the growing consumer preference for sustainable packaging. Their investments in research and development are expected to drive market growth in the coming years.

Smaller players like Benders Paper Cups and Constantia Flexibles are also making strides by offering specialized products for niche markets, such as compostable cups for the food service industry.

List of Key Disposable Cup and Lid Manufacturers

Regional Analysis: Disposable Cup and Lid Market

North America

The North American market is driven by stringent environmental regulations, including bans on single-use plastics in several states. The U.S. and Canada are witnessing a shift toward sustainable alternatives, with paper-based cups and compostable lids gaining traction. The food service sector remains the largest consumer, accounting for over 60% of the market share. Major chains like Starbucks and McDonald’s are transitioning to eco-friendly solutions, boosting demand for paper and fiber-based products.

Europe

Europe leads in sustainability initiatives, with the EU Single-Use Plastics Directive accelerating the adoption of biodegradable and recyclable cups and lids. Germany, France, and the U.K. are key markets, with food service and retail sectors driving demand. The region’s well-established recycling infrastructure supports the circular economy, encouraging manufacturers to invest in compostable materials. However, higher production costs remain a challenge for widespread adoption.

Asia-Pacific

Asia-Pacific dominates the global market, accounting for the highest consumption due to rapid urbanization and a booming food service industry. China and India are the largest consumers, with plastic cups still prevalent due to affordability. However, government regulations and rising environmental awareness are gradually shifting demand toward paper and fiber-based alternatives. The region’s fast-food chains and beverage brands are increasingly adopting sustainable packaging to meet consumer expectations.

Latin America

Latin America is experiencing steady growth, driven by expanding food service and retail sectors. Brazil and Mexico are the largest markets, with plastic cups remaining popular due to cost-effectiveness. While sustainability awareness is growing, economic constraints and limited recycling infrastructure slow the transition to eco-friendly alternatives. However, multinational brands are introducing compostable options, signaling a gradual shift in consumer behavior.

Middle East & Africa

The Middle East and Africa are emerging markets, with demand primarily driven by tourism and hospitality sectors. Plastic cups dominate due to their affordability, but sustainability initiatives in countries like the UAE and South Africa are encouraging the adoption of biodegradable alternatives. Limited infrastructure and regulatory challenges hinder rapid adoption, but long-term growth potential remains strong as urbanization and disposable incomes rise.

Segment Analysis:

By Material Type

Plastic Segment Dominates the Market Due to Cost-Effectiveness and Versatility

The market is segmented based on material type into:

Plastic

Metal

Other Materials

By Application

Food Service Segment Leads Due to High Demand for Takeaway and Delivery Packaging

The market is segmented based on application into:

By Product Type

Hot Beverage Cups Segment Holds Major Share Due to Coffee and Tea Consumption

The market is segmented based on product type into:

By Distribution Channel

Business-to-Business (B2B) Segment Dominates Through Direct Supply Chains

The market is segmented based on distribution channel into:

Business-to-Business (B2B)

Business-to-Consumer (B2C)

Report Scope

This report presents a comprehensive analysis of the global and regional markets for Disposable Cups and Lids, covering the period from 2024 to 2032. It includes detailed insights into the current market status and outlook across various regions and countries, with specific focus on:

Sales, sales volume, and revenue forecasts

Detailed segmentation by type and application

In addition, the report offers in-depth profiles of key industry players, including:

Company profiles

Product specifications

Production capacity and sales

Revenue, pricing, gross margins

Sales performance

It further examines the competitive landscape, highlighting the major vendors and identifying the critical factors expected to challenge market growth.

As part of this research, we surveyed Disposable Cups and Lids companies and industry experts. The survey covered various aspects, including

Revenue and demand trends

Product types and recent developments

Strategic plans and market drivers

Industry challenges, obstacles, and potential risks

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Disposable Cups and Lids Market?

->Global disposable cups and lids market was valued at USD 21.35 billion in 2024 and is projected to reach USD 28.96 billion by 2032, exhibiting a CAGR of 3.9% during the forecast period.

Which key companies operate in Global Disposable Cups and Lids Market?

-> Key players include Huhtamaki, Dart Container, Georgia-Pacific, International Paper, BAWOO Print & Paper Cups, Berry Global, and Greiner Packaging, among others.

What are the key growth drivers?

-> Key growth drivers include rising demand in food service industries, growth in online food delivery, and increasing consumer preference for convenient packaging solutions.

Which region dominates the market?

-> North America currently holds the largest market share, while Asia-Pacific is expected to witness the highest growth rate due to rapid urbanization and expanding food service industries.

What are the emerging trends?

-> Emerging trends include sustainable/biodegradable material adoption, smart packaging solutions, and innovations in heat retention technologies.

Table of Content:

1 Disposable Cups and Lids Market Overview

1.1 Product Overview and Scope of Disposable Cups and Lids

1.2 Disposable Cups and Lids Segment by Type

1.2.1 Global Disposable Cups and Lids Market Size Growth Rate Analysis by Type 2024 VS 2032

1.2.2 Plastic

1.2.3 Paper and Fiber

1.2.4 Metal

1.2.5 Other

1.3 Disposable Cups and Lids Segment by Application

1.3.1 Global Disposable Cups and Lids Consumption Comparison by Application: 2024 VS 2032

1.3.2 Food and Beverage Processing Plant

1.3.3 Food Services

1.3.4 Retail Industry

1.3.5 Other

1.4 Global Market Growth Prospects

1.4.1 Global Disposable Cups and Lids Revenue Estimates and Forecasts (2018-2032)

1.4.2 Global Disposable Cups and Lids Production Capacity Estimates and Forecasts (2018-2032)

1.4.3 Global Disposable Cups and Lids Production Estimates and Forecasts (2018-2032)

1.5 Global Market Size by Region

1.5.1 Global Disposable Cups and Lids Market Size Estimates and Forecasts by Region: 2018 VS 2022 VS 2032

1.5.2 North America Disposable Cups and Lids Estimates and Forecasts (2018-2032)

1.5.3 Europe Disposable Cups and Lids Estimates and Forecasts (2018-2032)

1.5.4 China Disposable Cups and Lids Estimates and Forecasts (2018-2032)

1.5.5 Japan Disposable Cups and Lids Estimates and Forecasts (2018-2032)

2 Market Competition by Manufacturers

CONTACT US:

203A, City Vista, Fountain Road, Kharadi, Pune, India - 411014

International: +1(332) 2424 294

Asia: +91 9169162030

Follow Us On LinkedIn: 24ChemicalResearch LinkedIn